These markets can produce the scaled financing and incentives needed for businesses and economies to better align with the Global Biodiversity Framework and the Paris Agreement.

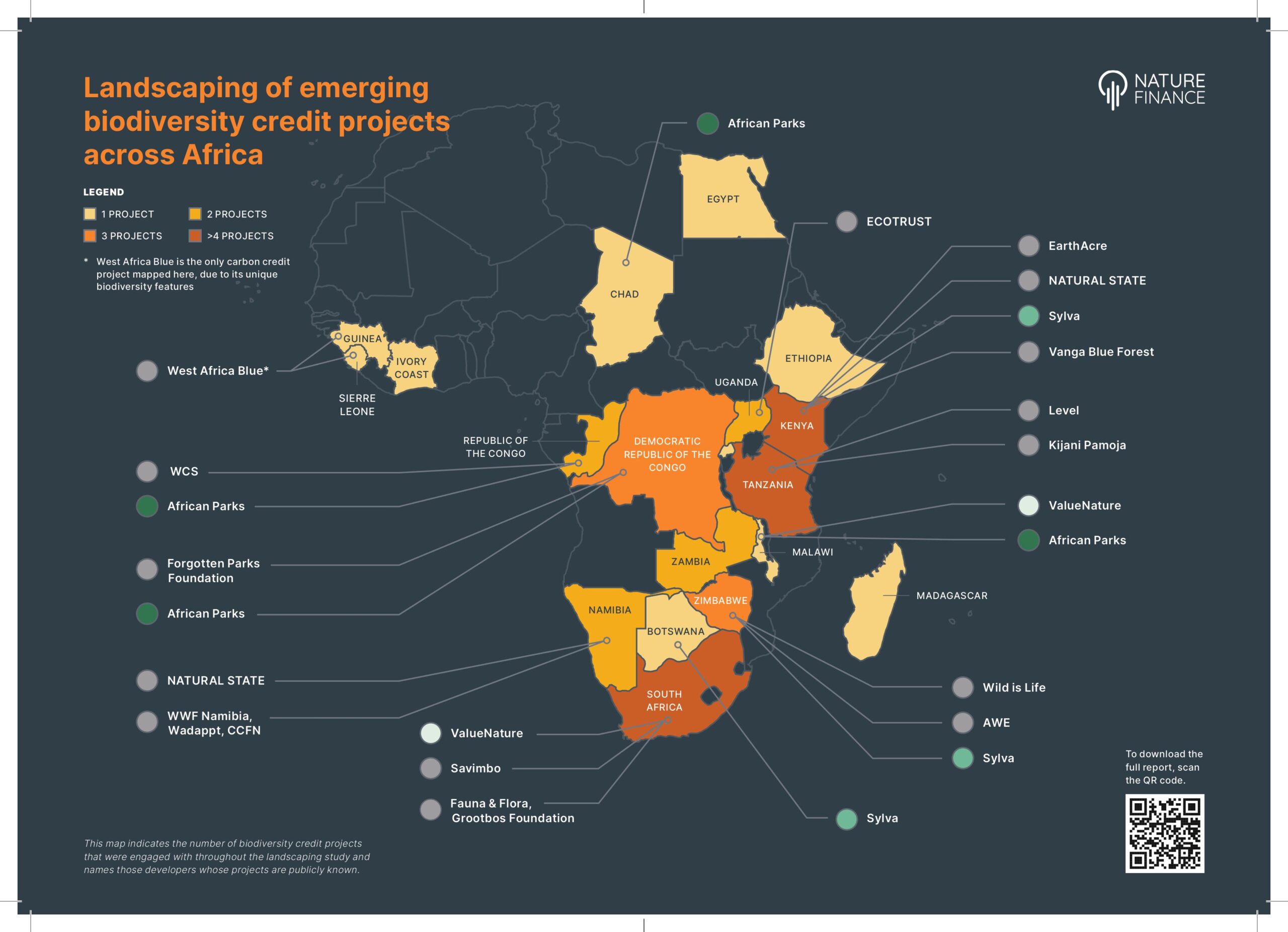

The biodiversity credit market is projected to experience growth in the coming years, driven by factors such as increasing recognition of the economic value of biodiversity, growing pressure on businesses to counter their environmental impacts, and potential integration of biodiversity credits into emerging markets.

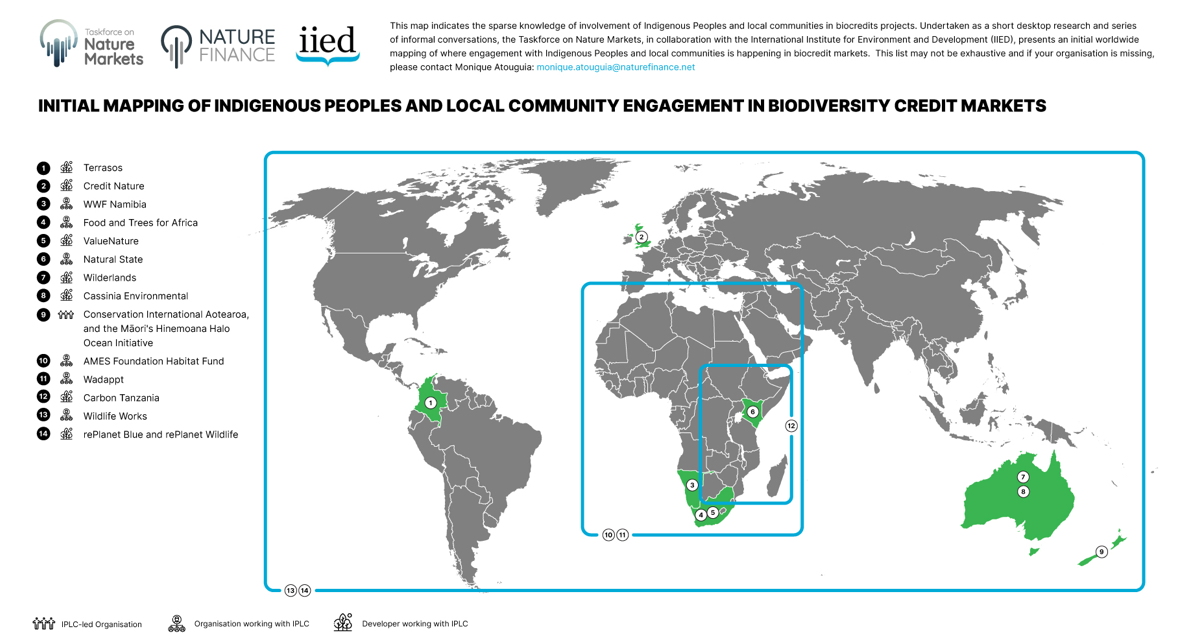

Building high-integrity, high-performing biodiversity credit markets requires a radical level of transparency and accountability, accreditation for traders, that indigenous peoples and local communities’ voices are heard, interested stakeholders visible, minimum price floors established and international governance arrangements upgraded.

These emerging markets require legal underpinning and governance structures for all market actors. If governed and structured well, biocredit markets can provide an innovative way to channel investment into biodiversity conservation and restoration, including private investment which has been critically missing to date.

NatureFinance is working with a number of organisations to develop frameworks and recommendations in shaping high-performance and high-integrity biodiversity credit markets.

By recognising the value of nature, biocredits could change business behaviour, creating an opportunity cost of nature destruction. Markets can level the playing field in terms of equity, rights and ownership and indigenous communities, reinforcing their rights and way of life.