This Taskforce on Nature Markets paper, prepared in collaboration with Pollination, explores requirements and recommendations for a legal, policy and regulatory framework to guide the development of high integrity biodiversity credit markets. With robust governance and integrity measures, these markets have the potential to deliver nature-positive and equitable outcomes while providing an innovative and scalable source of finance for nature.

About the paper

As voluntary biodiversity credit markets continue to scale and mature, the complexity of biodiversity may no longer be a barrier to scaling investment. For these markets to reach their potential and not result in perverse outcomes the establishment of a robust governance framework underpinned by laws, policies and regulations will be critical.

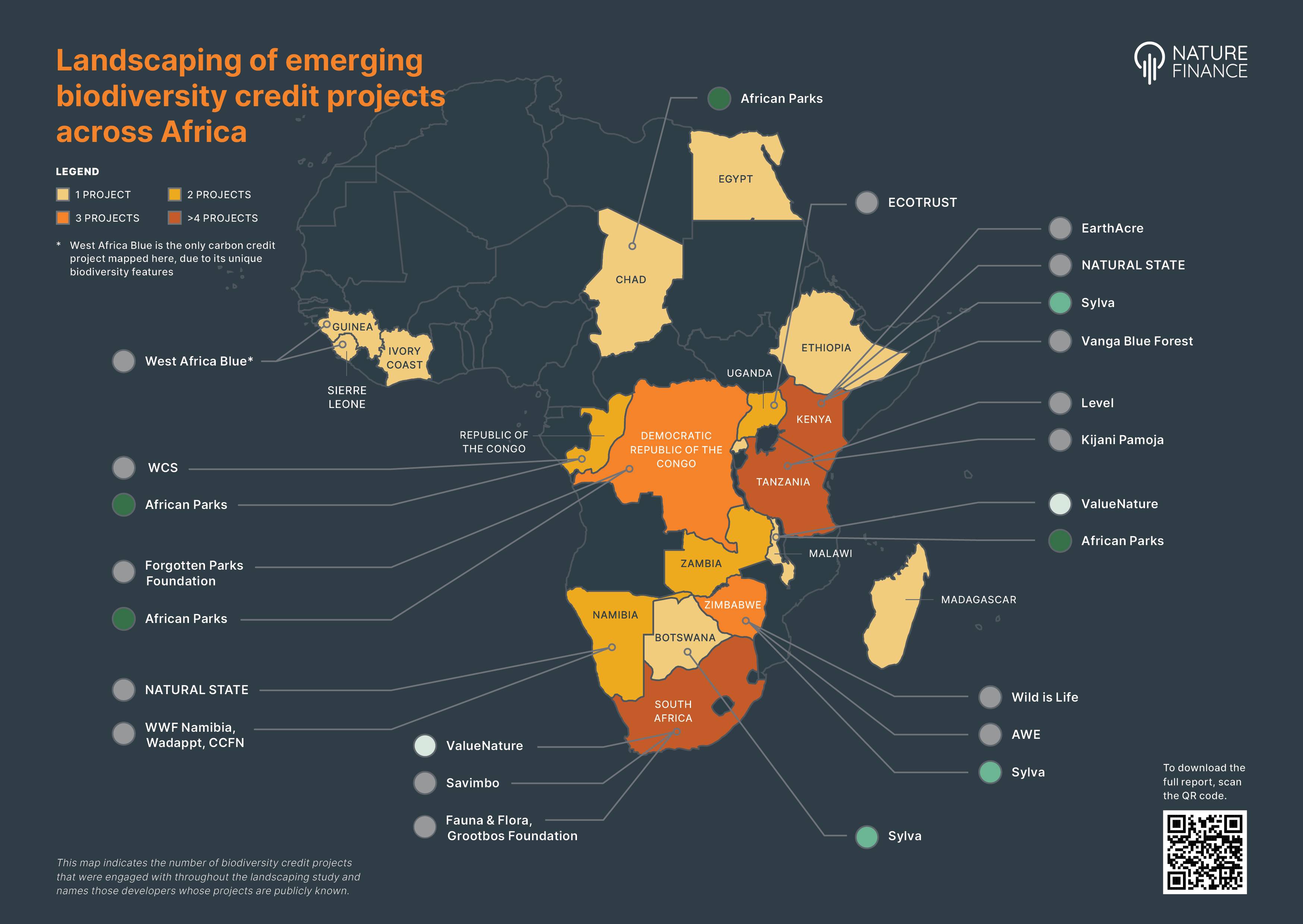

This paper examines developments in biodiversity credit markets across the public and private sector, explores the requirements for scalable, high integrity biodiversity credit markets, and sets out high-level principles and recommendations to achieve these outcomes.

Key Themes

- Role of law, regulations and policy for developing unit-based nature markets

- Lessons learned from biodiversity offset schemes

- Emerging biodiversity credit markets

- Legal, regulatory, policy and governance considerations

- Scaling biodiversity credit markets

Highlights

- Over the last three decades, conservation organisations have collaborated with both the public and private sectors to create innovative mechanisms that finance positive biodiversity outcomes. As of 2019, current spending on biodiversity conservation was estimated to be between $124 and $143 billion per year, leaving an estimated financing gap of between US$ 598 billion and US$ 824 billion per year to address global biodiversity loss.

- An examination of case studies is presented in this paper, identifying current biodiversity credit market initiatives in both the private and government sectors, highlighting initiatives underway in New Zealand, Colombia, Australia, Niue and other parts of the world.

- Target 19 of the Kunming-Montreal Global Biodiversity Framework expressly refers to biodiversity credits as a potential mechanism for financial resource mobilisation. Setting the international rules for biodiversity credit markets should be prioritised in future CBD negotiations and protocols to help mainstream the use of private capital to achieve positive biodiversity outcomes, and set universal expectations around scheme design and safeguards for IPLCs, including the need for FPIC and meaningful benefit sharing.

- Although biodiversity credit markets are nascent, biodiversity credits also represent a financial asset. This paper maps out potential legal enablers to scale private sector investment in biodiversity credit markets including natural capital accounting, nature-related risks disclosure and potential taxes and trading systems.

- The paper urges all stakeholders to engage in the emerging governance framework for biodiversity credit markets, which encompasses law, regulation, policy and soft governance approaches. This is not only to avoid perverse outcomes but also to instil confidence in the market. The paper proposes high-level principles and recommendations to ensure high-integrity outcomes.

Contact and more information

For more information contact Monique Atouguia: moniqueatouguia@naturefinance.net

For media and communications enquiries contact Ceandra Faria: ceandra.faria@naturefinance.net