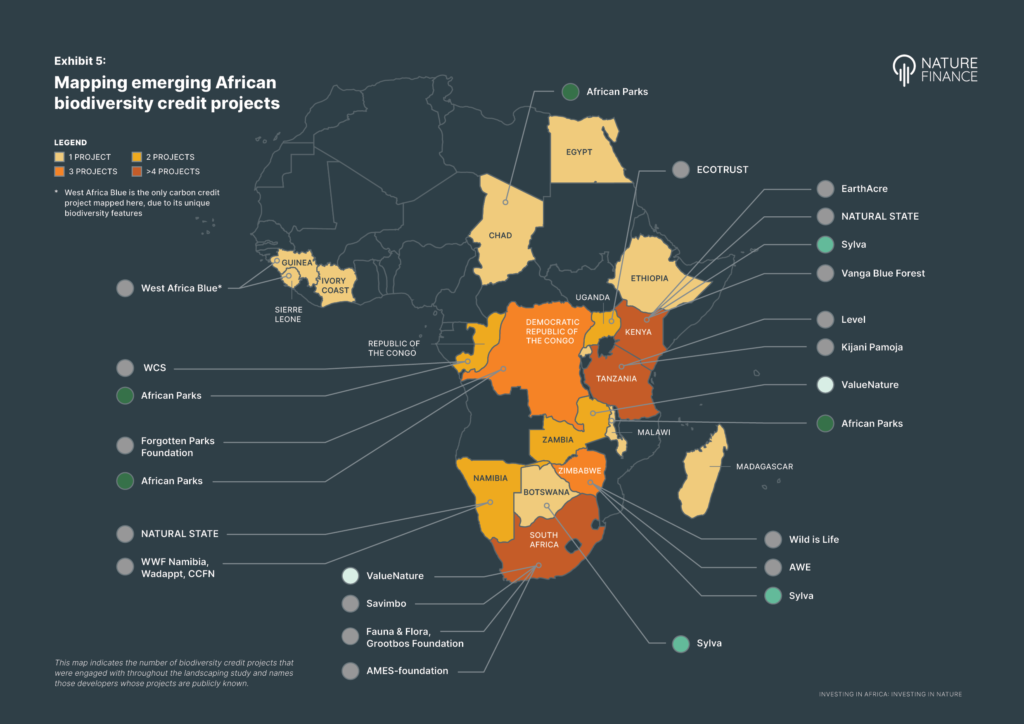

Investing in Africa: Investing in Nature maps and analyses the emerging landscape for biodiversity credits across the African continent and contextualises this emerging instrument to invest in nature within the larger emerging landscape of nature finance more broadly.

This landscaping study, conducted over a six-month period, and undertaken with interviews with nearly 100 stakeholders, found more than 30 biodiversity credit projects emerging across Africa.

The African innovation ecosystem is thriving, and includes project developers, IPLC coalitions and allies, development partners, academics, investor coalitions, intermediary NGOs and government partners all attempting to reckon with how biodiversity credits might help increase private finance at scale to ensure more sustainable long-term management of conservation and restoration efforts on the continent.

The study outlines ten key findings from this landscaping work, including among them:

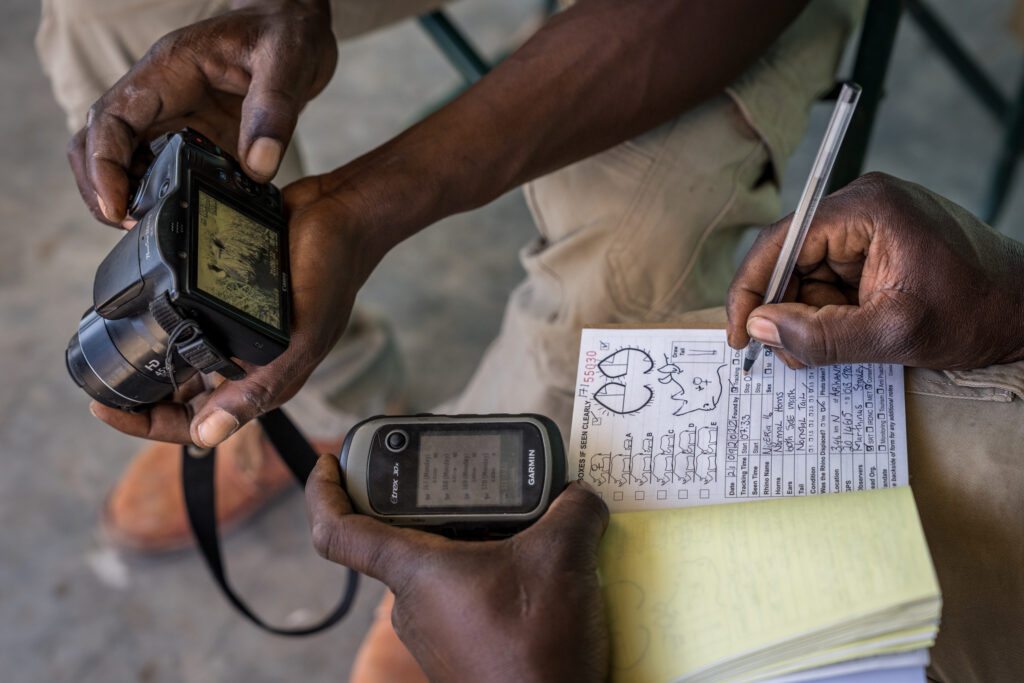

- Remarkable developments in monitoring, verification and reporting approaches that leverage real time local knowledge from IPLCs.

- Rapid advances in the ability to track the impact and integrity of credits over time in a transparent way via blockchain and remote sensing technologies.

- Emerging financial instruments to turn biodiversity credits into a distinct asset class for more equitable distribution of risk and rewards.

In addition to presenting six recommendations and recommended areas of intervention, this paper also puts forward three potential market development scenarios for the development of African biodiversity credit markets and the implications of each across the African and international nature finance ecosystem. These include:

- A localised, community-led market development scenario

- A globalised, market-based scenario

- An orchestrated, policy enabled scenario

The opportunity has never been greater for policymakers and investors to create the market conditions for investment in nature-related conservation and restoration across Africa. To dive in further, download the full report below.

The landscaping and stakeholder engagement was undertaken with the support of Advancing Green and made possible with support and partnership from FSD Africa.

NatureFinance wishes to thank all the landscaping study participants both for their invaluable contributions and for their tireless work in conservation across the continent.

NatureFinance also wishes to thank the experts who inputted and guided this process in their role as Advisory Group members throughout the study.

Contact and more information:

For more information, please reach out to Monique Atouguia, moniqueatouguia@naturefinance.net

For media & communications inquiries, please reach out to Anastasia Biselli, anastasia.biselli@naturefinance.net