The first ever Africa Climate Summit (ACS), hosted by the Republic of Kenya and the African Union Commission was held in Nairobi, from 4-6 September. The Africa Climate Week took place in parallel.

The events gathered 20 African heads of state and 30 000 policymakers, practitioners, businesses and civil society around a bold message: Africa is not just a continent vulnerable to climate impacts; it also has the potential and ambition to lead the world in climate and nature-base solutions.

- The Nairobi Declaration, adopted unanimously by African leaders, capped three days of discussions dominated by mobilising finance to tackle climate impacts, natural capital conservation and a renewable energy transition resulted in.

- The Africa Climate Summit was announced as a biennial event convened by African Union and hosted by AU Member States, to set the continent’s new vision, taking into consideration emerging global climate and development issues.

- Commitments and announcements by African and non-African governments, public and private sectors, banks, MDBs, foundations and civil society equate to a combined investment of nearly US$26 billion.

- Despite the inaugural African joint statement on climate and billions committed to climate action, some groups raised concerns about the spotlight on climate finance and green growth, including risks of greenwashing and commodification of Africa’s natural resources.

Highlights from the Nairobi Declaration

- The declaration urges world leaders “to rally behind the proposal for a global carbon taxation regime including a carbon tax on fossil fuel trade, maritime transport and aviation.”

- Demands reforms in the financial system to scale up funds for climate action

- Calls for debt relief across the continent, asking multilateral development banks to increase concessional lending to poorer countries and for the “better deployment” of the IMF’s special drawing rights mechanism.

- It will form the basis of Africa’s negotiating position at November’s COP28.

Side event: Catalysing private-sector capital through credit enhancement and sustainability-linked sovereign financing

Co-hosted by the Sustainability-linked Sovereign Debt Hub, The Nature Conservancy (TNC) and the UN High Level Climate Champions.

- Bogolo Joy Kenewendo, UN Climate Change Special Advisor and Africa Director, highlighted the multiplied effect on MDB’s providing the finance, also exploring how scale innovative financial instruments can crowd investments or reduce a country’s debt burden and pointing to scale risk and credit enhancement solutions like guarantees that can help catalyse private-sector investment.

- Panelists discussed opportunities for Africa leveraging its natural assets and risks as cost of climate, biodiversity loss and debt burden. Also central to the debate were sustainability-linked bonds, debt-for-nature swap, lack of fiscal space in Africa, credit enhancement for sovereigns to help meet financing gaps, and the key role of multistakeholder collaboration.

- There was a resounding call to action at COP28 on unlocking credit enhancement for sustainability-linked debt. The moderator noted the collaboration between TNC, UNFCC Climate Champions, and SSDH over the past months on developing a roadmap for COP28, including events at the Paris Summit on a New Global Financing Pact and a “Design Sprint on Collaborative Credit Enhancement Mechanisms” in Washington DC.

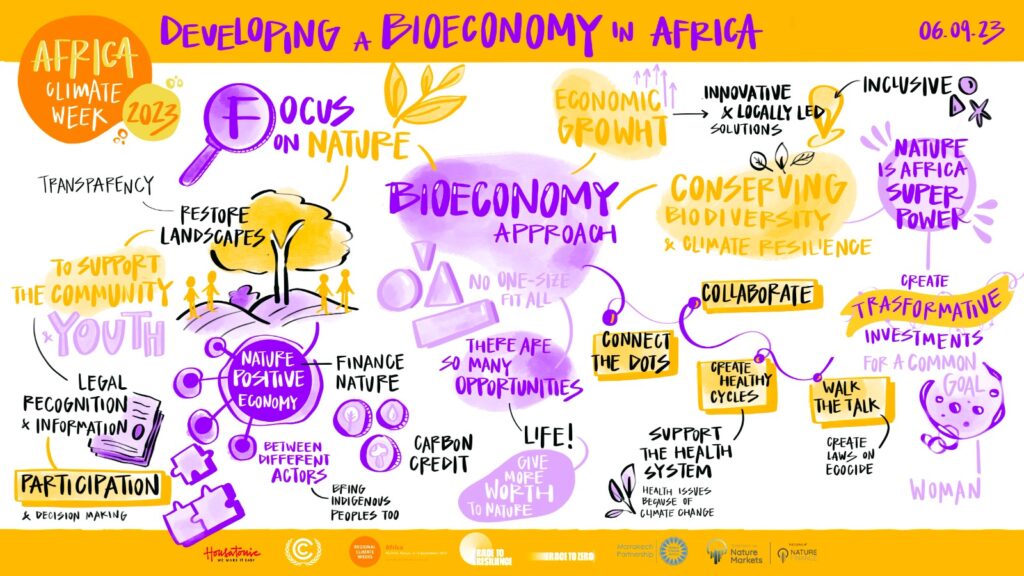

Side event: Developing a Bioeconomy in Africa

Co-hosted by the Taskforce on Nature Markets and the UN High-Level Climate Champions.

- At the top of the agenda was the engagement and empowerment of grassroots communities, the need to connect nature conservation and opportunities to mainstream its value across the economy, creating prosperity for people and planet.

- On the finance side, panellists agreed that there is financial loss due to nature degradation and investors need to walk the talk. They highlighted the need to ensure access to markets, long-term investment and cash flow in developing economies as well as more flexible terms of financing.

- In line with the 7 recommendations recently launched by the Taskforce’s final report, Making Nature Markets Work, there was a strong call on policy and (public/private) finance alignment to build the right governance, aiming at delivering a climate resilient, equitable and nature positive economy.

If you missed the event you can watch the recording below.

For more information about Africa’s natural capital in the run-up to Africa Climate Summit & Week, read this Op-ED piece published by Nature Finance and Africa Climate Foundation in Mail & Guardian.