About the paper

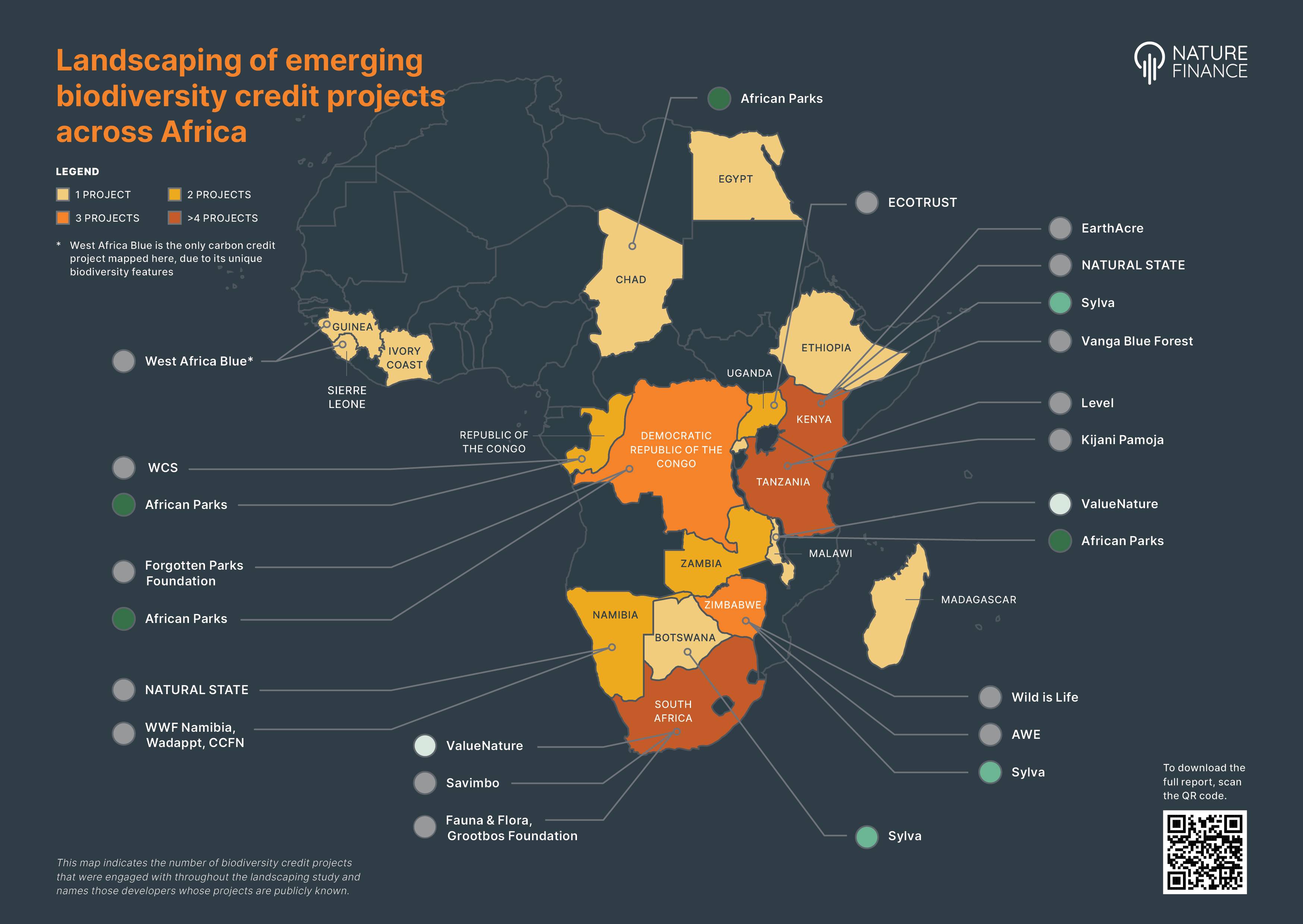

This Taskforce on Nature Markets paper, with the Igarapé Institute’s Peter Smith, explores the insights shared by industry experts and insiders across food, agriculture, finance, international trade and sustainability, with the goal of identifying market interventions that could promote nature positive and equitable outcomes. These in-depth interviews shed light on the various roles of investors, financial institutions, governments and consumers in shaping food markets toward these desired outcomes. Secondly, the paper explores the literature and presents analysis on three commodity-specific case studies, specifically, soybeans in Brazil, palm oil in Southeast Asia and cocoa in West Africa, as well as an additional regional case study assessing the potential of AfCFTA to transform African soft commodity markets.

Key themes

- Food related soft commodity markets

- Nature positive outcomes

- Market interventions

- Nature positive and equitable governance

Highlights

- Food related soft commodity markets are the second largest global nature market by type, scale and monetary value(at US$4.3 trillion a year in global production), and therefore play a crucial role in the development and expansion of nature markets worldwide

- The imperative of transforming soft commodity markets is driven home by the fact that the expansion of commercial agriculture represents the main direct cause of tropical forest loss.

- Insufficient sourcing methods and gaps in traceability threaten to exacerbate the illegal deforestation of critical ecosystems and (directly or indirectly) perpetuate human rights violations, at the same time that rising food prices due to global demand and unforeseen economic shocks exert significant pressure to expand commodity production.

- Well governed nature markets need clear boundaries in which important elements of nature are out of bounds for markets. This requires strong legal protection and standing as well as clear and well enforced liability for those who transgress these boundaries. The soy moratorium case study provides helpful insight into the effects creating clear boundaries can have across direct and indirect markets and across value chains.

- These markets require stronger competition regulation and curbing speculation, enabling improved nature positive and equity capacity therein. These entities also need to improve their cross-jurisdictional regulating and prosecuting authorities to prevent arbitrage.

- Information asymmetry must be addressed across food related value chains from supply to consumption. This governance intervention falls on every actor within the value chain of nature markets to address and uphold.

“The in-depth interviews which have shaped this paper, were conducted with industry insiders across food, agriculture, finance, international trade and sustainability. They revealed the extent of the opacity of these markets, as well as the vertical and horizontal concentration which makes these markets so resistant to change. Overall, the food markets that feed the world are plagued by perverse incentives, poor market wide governance and information asymmetries. Improving governance in these markets holds profound lessons for nature markets.”

– Marcelo Furtado, Taskforce on Nature Markets Co-Lead

Contact and more information

For more information, please email Monique Atouguia: moniqueatouguia@naturefinance.net

For media and communications, please contact Ceandra Faria: ceandra.faria@f4b-initiative.net