The investment required to protect nature by 2030 is estimated at USD 1 trillion1. Estimates indicate that 55% of global GDP is dependent on nature2. This means that if ecosystems collapse, we face a potential loss of USD 58 trillion3. In other words, an investment of USD 1 trillion could yield an annual return of USD 58 trillion – an ROA that should pique the interest of even the most seasoned investors. Of course, this does not take into account that many aspects of the current GDP are generated in an unsustainable manner.

How can we stimulate equitable and nature-positive outcomes, creating a virtuous cycle of investment and innovation? Let’s pre-empt the narrow scope of solely investing in nature-based solutions. While they can provide an excellent way of funding the restoration and regeneration of nature, they are only a piece of the puzzle. To truly move the needle, we need to consider how nature flows through the financial system as well as consider possible solutions to alleviate pressure on nature’s resources. In a recent study, it was estimated that the scale of nature-negative finance flows is nearly USD 7 trillion per year4. Equally, today’s global food system – valued at USD 8 trillion – is estimated to have negative impacts worth USD12 trillion5.

Encouragingly, nature is making its way into business and market-shaping policies, as regulations and standards are evolving rapidly. We are also seeing a step change in citizen perspectives as consumers, investors, taxpayers and voters realise that they have agency. To truly change the plumbing of the financial system and its funding flows, we need to equip ourselves with data, relevant analytic tools, and financial instruments to help inform the right decisions.

We need solutions to understand nature’s impacts and dependencies at the level of a farmer or fisherman, an ecosystem, a company, a financial portfolio, and for governments and regulators. We need tools that allow companies to understand their value chains and adjust sourcing models. Investable opportunities at scale are needed to implement changes in ecosystems—on land and water. We need improved and affordable technology to monitor the impact of such changes and to make smarter decisions about managing ecosystems. Novel approaches are needed to de-risk interventions in ecosystems for all those who invest and benefit. Most importantly, we need to apply mechanisms that ensure equitable markets with investment directed to the stewards of nature, rather than the middlemen.

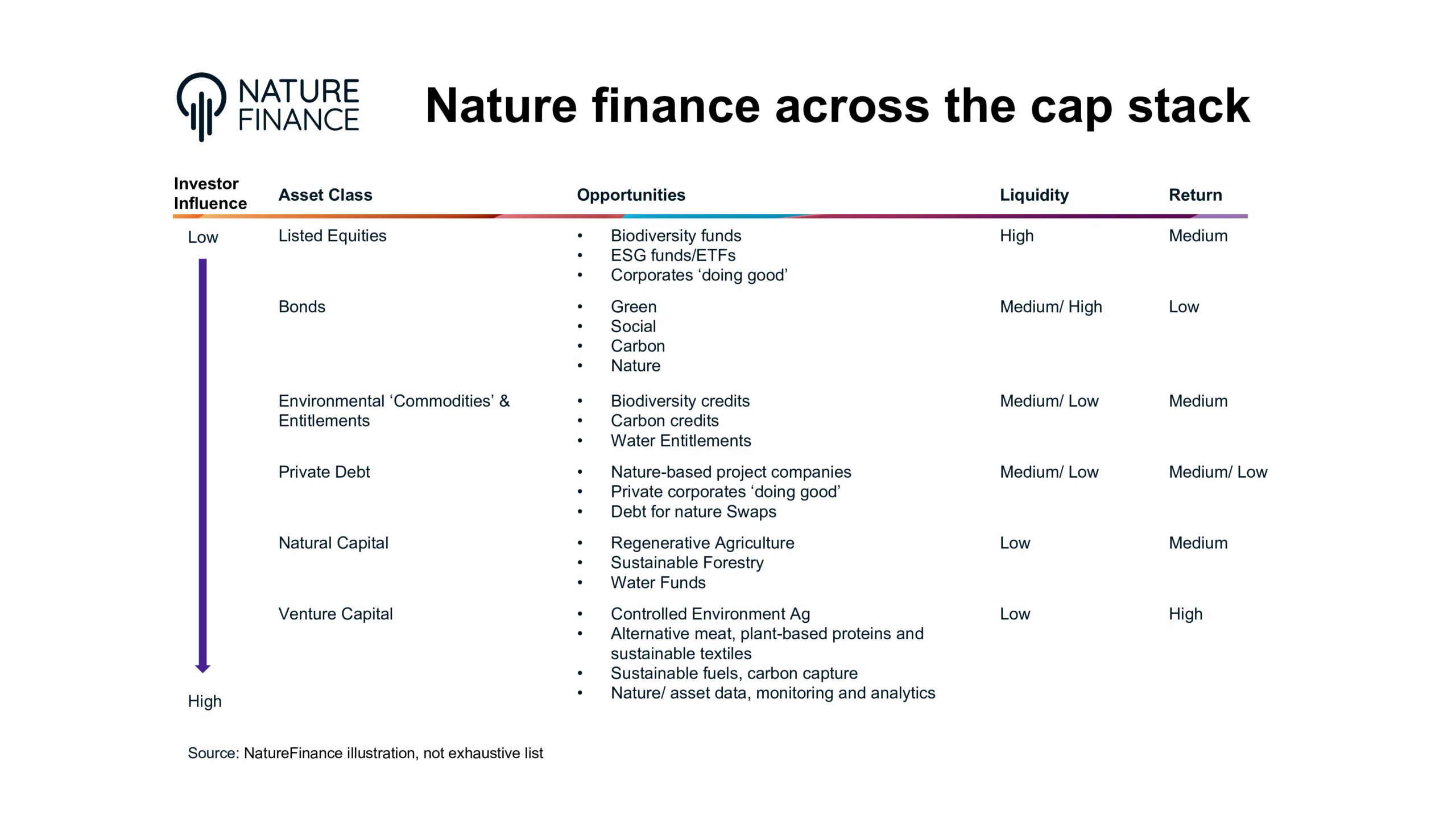

Early-stage investments have historically played an outsized role of catalysing rapid shifts. We now need to move at scale and fast. They can support unlocking technological, political, or design barriers that are currently blocking nature to be visible in markets and investable in an equitable, high-integrity way. This cohort of young, potential paradigm shifters, require a robust capital stack to fuel their growth, comprising not only various funding sources but also different types of actors.

Parallels can be drawn to the clean tech evolution, where the adoption of renewable energy production was fuelled by government subsidies and long-term offtake agreements designed to reduce the risk profile and make the investments more palatable for investors. This created an upward spiral, allowing further investment into improved technologies and reduced costs.

What can we learn from that? What do we need to do differently? Beyond the stack of equity, debt, and convertibles – how can we apply financial mechanisms to de-risk investments and encourage greater participation? Offtake agreements already exist for some nature-based solutions (i.e., carbon), as do pre-financing arrangements in this space, and yet clearly these are not enough yet. What subsidies and regulation could be enabling? How do we set up regional financing structures that understand the complexities of nature in specific parts of the world? How do such structures interact with the global capital markets? And what role do early-stage investors play?

What’s missing are the soft financial assets that investors can provide: business models anchored in science, rigor, patience, partnerships, and support in navigating the strong regulatory waves. This is the glue that holds it all together. Nature, especially biodiversity, is intricate, all the more so when it interfaces with market dynamics. It is important to understand the intricate web of relationships within complex systems. Patient and strategic capital is essential to support the ventures creating the markets and tools we need.

By investing in pioneering ventures, we can attract mainstream investment to vital, yet often neglected areas, thereby driving a shift towards a more sustainable and just future. A small and meaningful step would be to develop frameworks that allow investors to understand if an early-stage venture is creating and equitable, and a nature positive solution. The Nature Investor Circle, launched by NatureFinance, is working on such a framework. This community aims to spearhead this transformation by uniting a diverse group of stakeholders—including early-stage investors, entrepreneurs, thought leaders, and scientists. We are deep-diving into how to create a financing stack for equitable nature positive early-stage ventures- this is an open invitation to join this exploration, for anyone who shares the vision of shaping a just nature-positive and net zero future.

Co-Authors: Hiba Larsson NatureFinance, Jamie Batho The Landbanking Group

4 https://sdg.iisd.org/news/unep-report-exposes-disparity-between-nbs-nature-negative-finance-flows/

5 https://www.naturefinance.net/making-change/nature-markets/food-finance-nexus/