This Taskforce on Nature Markets report, with knowledge partners Vivid Economics by McKinsey, landscapes for the first time the current economic value of nature markets, providing a more technical taxonomy, analysis, and trends.

The study finds that nature markets make up $9.8 trillion worth of goods and services — equivalent to 10 percent of global GDP. But the explicit value of nature in markets represents a fraction of nature’s true value. Improved market governance and infrastructure across these markets can likely change these incentives.

Nature markets are not well understood and often under-price the nature upon which they depend, leading to an inefficient use of natural resources, and enabling nature destructive incentives throughout markets. The report finds that only a small segment of nature markets are currently designed to achieve nature-positive and equitable outcomes.

Key themes

- Economic value of nature markets – including 24 emerging and established markets

- Technical taxonomy: types of nature markets

- Understand the current state of nature markets

- Analysis and trends in nature markets

- Key Implications for governance of nature markets

Highlights

- The study finds that nature markets make up $9.8 trillion worth of goods and services — equivalent to 10 percent of global GDP, and the third biggest global economy after the USA and China.

- Agriculture and livestock markets, represent US$4.3 trillion alone, making them the largest nature market after extractive commodities (mining, minerals, oil and gas) – valued at US$4.6 trillion.

- Market distortions are laid bare: soft commodities market value is concentrated in livestock and dairy production, with animal-based production worth US$2 trillion, making up 44% of the market value.

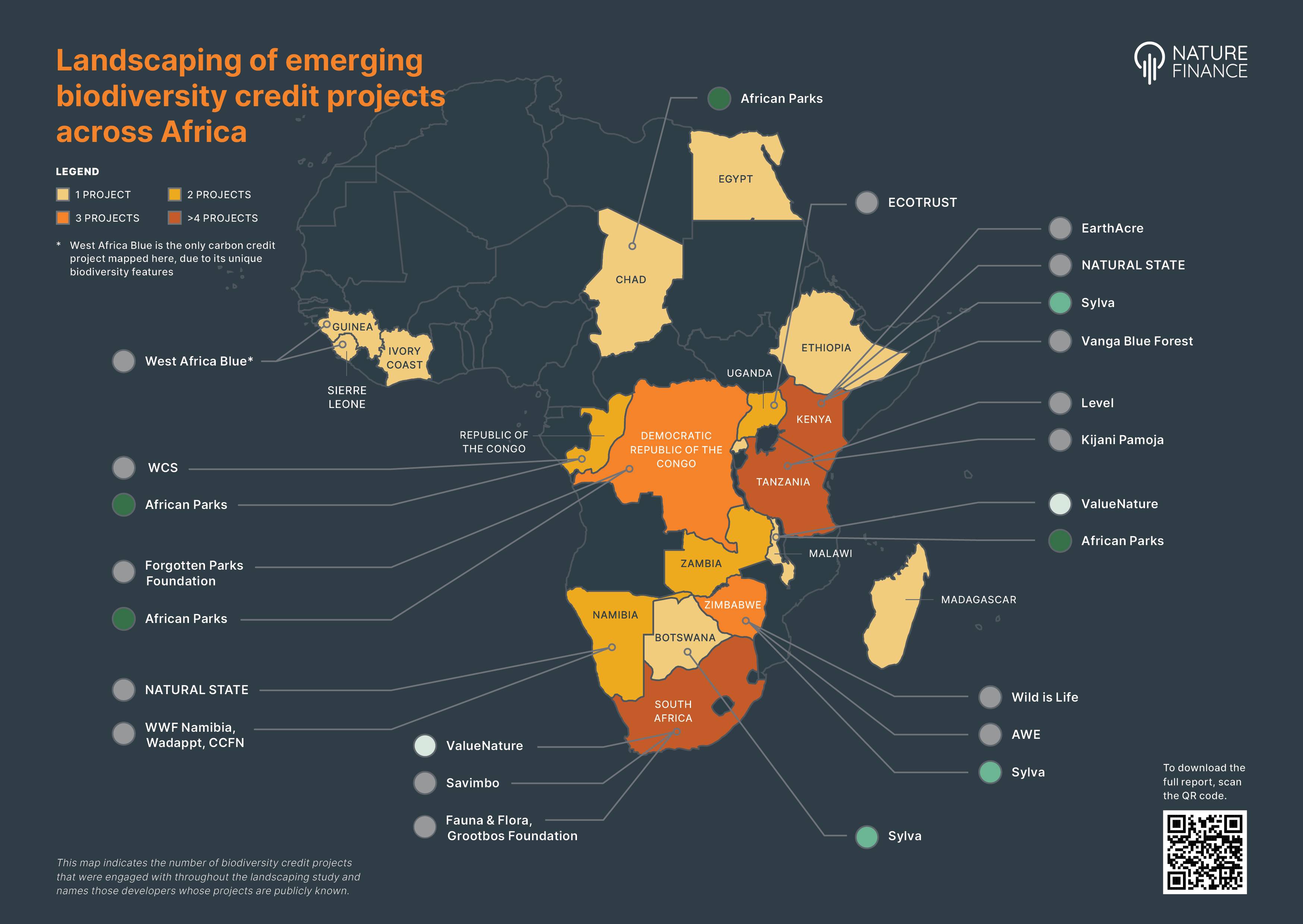

- Emerging markets, such as voluntary carbon credit markets are worth US$1.3 billion and entering growth at scale, much like the markets for insurance and sustainability linked bonds. Likewise payments for ecosystem services and nature-specific credits are gaining traction.

- Multiple nature markets are already seeing increased demand for ecosystem services that support climate change mitigation (e.g., carbon credits) and climate change adaptation (e.g., crop insurance).

- The rise of nature markets provides a window of opportunity, but will not automatically deliver equitable, nature positive outcomes. Nature markets explicitly value nature-based products and ecosystem services that are traded. In this, they make visible the form and extent of those goods and services, and the value attributed by markets to them. That information makes it possible to assess the impact of the market on nature, and the distribution of the associated economic benefits and the forms of nature that are valued in markets (as well as those that are not).

Contact and more information

For more information, please email Monique Atouguia: moniqueatouguia@naturefinance.net

For media and communications, please contact Ceandra Faria: ceandra.faria@naturefinance.net