The bioeconomy has emerged as a transformative development model, aligning economic growth with environmental conservation in the Amazon. In the face of escalating climate and biodiversity crises, the sustainable bioeconomy – also known as the socio-bioeconomy – offers a pathway that emphasizes products and services that uphold ecological integrity while respecting the cultural identity and traditional knowledge of local communities.

A new report by the Pan-Amazon Network for the Bioeconomy, supported by NatureFinance and Impact Finance, presents the first comprehensive mapping of 141 financial mechanisms supporting the socio-bioeconomy across the Pan-Amazon region. The study, aimed at decision-makers including financiers, entrepreneurs and community organizations, examines success factors and bottlenecks in driving impact and provides practical recommendations to strengthen the financing ecosystem.

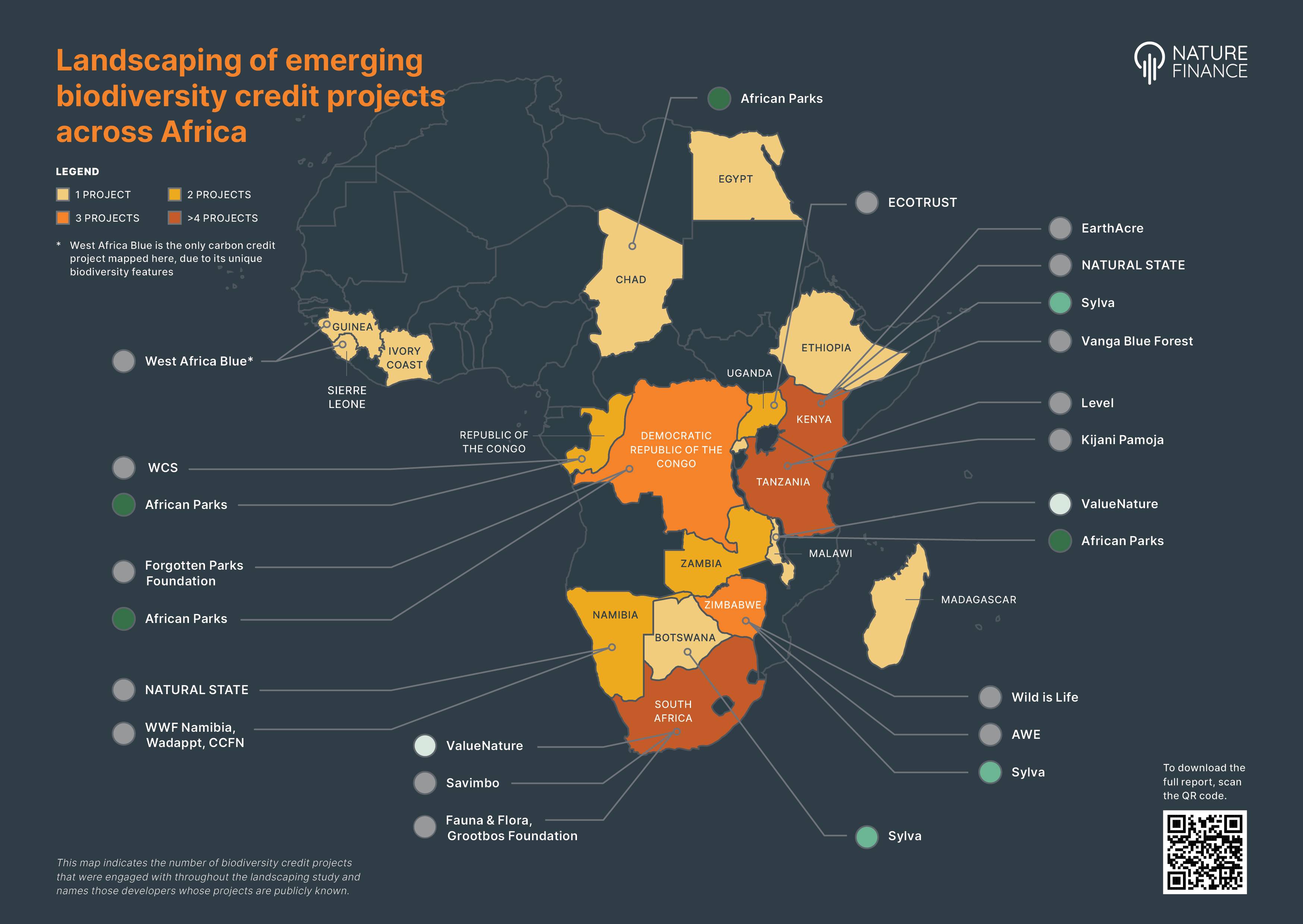

The report reveals a diverse yet fragmented financial landscape, ranging from traditional grants and equity funds to innovative instruments such as biodiversity credits, habitat banks and debt-for-nature swaps. The main challenges identified are not the lack of financing options but the need for better coordination, simpler access for local entrepreneurs and financial instruments adapted to local contexts, ensuring communities can secure the capital necessary to transition toward a sustainable bioeconomy.

Key findings

- Strengthen coordination and strategic alignment: Although a solid foundation of financial mechanisms exists, the financing ecosystem would benefit from better alignment and coordination. Enhancing connections among actors, simplifying access and fostering synergies can make financing more efficient and impactful.

- Increase accessibility and local inclusion: Processes should be simplified and financial instruments designed to fit local contexts, ensuring Indigenous Peoples, traditional communities and small-scale entrepreneurs can better access available financial resources. Current success criteria and performance metrics often rely on conventional economic references, which are not always compatible with the timelines and nature of community and forest-based initiatives.

- Expand blended and innovative finance models: Blended finance dominates the ecosystem, with 57.5% of mechanisms combining public, private and philanthropic capital. Scaling up these models can de-risk investments and attract larger funding flows into sustainable and inclusive bioeconomy sectors.