COP28 – the United Nations Climate Conference – held from November 30th to December 12th, 2023 in Dubai, United Arab Emirates (UAE) convened policy makers, business leaders, climate activists and members of civil society for ground-breaking, transformative discussions around global climate action.

About 100,000 participants attended COP28, with NatureFinance participating in over 30 events to align finance with nature, climate and equity in a moment of critical need for global transformative and radical climate thinking and actioning.

With science currently pointing at a world heading for a dangerous 2.5-2.9°C warming — way beyond the 1.5°C target of the Paris Agreement — key themes discussed at COP28 included finance, climate adaptation, resilience, decarbonising real estate and nature.

The integral role of both phasing out of fossil fuels to address climate challenges as well as the need to acknowledge nature’s role in safeguarding us from climate change and market impacts is clear and urgent.

Despite concerns expressed by civil society and climate activists due to the high number of fossil fuel lobbyists at COP28, the Conference produced important outcomes.

Watch: Five highs and lows from the conference

COP28 Highlights

- 134 countries producing 75% of all food-based greenhouse gas emissions and 200+ non-State actors signed a declaration to include food in their climate targets.

- The Alliance on food transformation was launched by several countries, including Brazil, who committed by COP30 to 10 priority actions to transform food and land use systems.

- Over USD$ 720 million pledged to a loss and damage fund – the equivalent of less than 0.2% of the irreversible economic and non-economic yearly losses of developing countries due to climate change.

- Some 50 oil and gas companies have agreed to cut out methane emissions by 2030. Meanwhile, civil society and climate activists keep calling for the complete phasing out of fossil fuels.

- 130 countries have agreed to triple renewable energy capacity and double the rate of energy efficiency by 2030 – still an insufficient target according to IEA analysis.

- Historic agreement to phase-out fossil fuels by 2050 amidst remaining criticism around the Global Stocktake‘s failure to include concrete actions needed to keep temperatures under 1.5C this century and to support vulnerable nations.

- Failure to agree on the crucial issue of climate change adaptation led to disappointment, particularly from African, Caribbean and Latin American countries.

“Even if we phase out all fossil fuels, if we do not get involved in nature, nature’s destruction can lead us to losing the safe future for humanity on Earth. It’s really decisive, that we get it right on nature [to stay within the 1.5C limit].” – Johan Rockström, Potsdam Institute for Climate Impact Research Director.

NatureFinance Key Takeaways

NatureFinance co-hosted 8 events and joined over 30 public events on the nature and finance nexus (agenda here).

A FUTURE BEYOND 1.5C

NatureFinance in partnership with GLOBE International co-hosted “Legislating for a Resilient Future: Nature and Finance Beyond 1.5°C”, an event bringing together a cross-party network of parliamentarians and global legislators as well as businesses to discuss the critical role of legislation in delivering a nature positive, net zero, equitable future in a world beyond 1.5C degrees.

SUSTAINABILITY-LINKED SOVEREIGN DEBT

A Joint Declaration and a new Task Force to enhance sovereign financing was launched by the world’s major Multilateral Development Banks (MDBs) with the support of the insurance industry. The Task Force’s Secretariat will be hosted by the Sustainability-linked Sovereign Debt Hub (SSDH). Read more here (soon).

The Asian Development Bank (ADB) supported by several partners including NatureFinance launched the Nature Finance Hub aimed at mobilising $1 billion from development partners and an additional $2 billion in private finance capital by 2030.

BIOCREDITS MARKETS

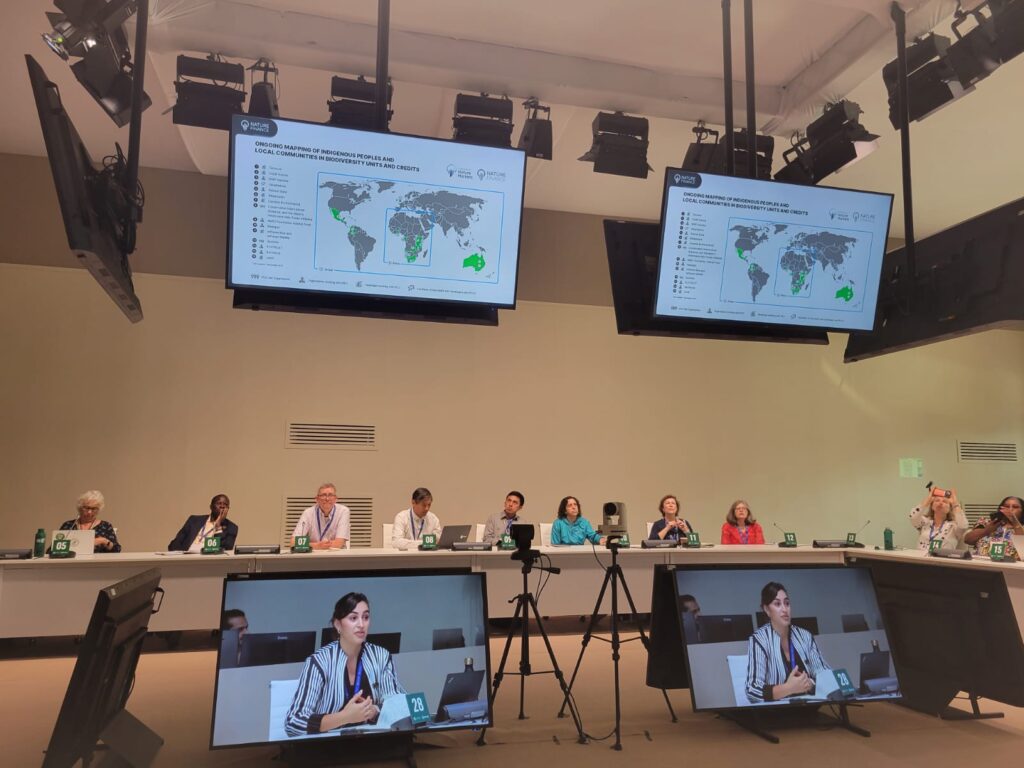

Aligned with Indigenous peoples demands at COP28 for more involvement in project planning and implementation, NatureFinance is collaborating with nature’s stewards towards more inclusive, equitable, and rights-based governance and conservation.

Indigenous Peoples and Local Community (IPLC) leaders and co-chairs of the International Advisory Panel on Biodiversity Credits (IAPB) discussed biodiversity credits and nature markets, emphasising learnings and opportunities for Global South nations.

A South-South learning implementation lab co-hosted by NatureFinance and FSD Africa united global investment stakeholders and multilateral development banks to leverage learnings from the Amazon and the African continent on establishing a robust, equitable biocredit market.

The High Ambition Platform for COP28-COP30 and Indigenous Peoples Vision was launched as a collective effort aimed at driving a transformative agenda for COP30, with Indigenous Peoples at the centre, and focusing on the preservation of the Amazon amongst other key biomes.

NATURE-FINANCE ALIGNMENT

NatureFinance co-hosted a session on biodiversity credits which gathered insights from Indigenous leaders, biodiversity credit issuers, African representatives, and development finance institutions.

Over 150 businesses and financial institutions announced plans around Financing for Nature-Based Climate Solutions through the adoption of Science-Based frameworks and the Taskforce on Nature- related Financial Disclosures (TNFD).

The Asian Infrastructure Investment Bank (AIIB) launched its 2023 report, “Nature as Infrastructure”, advocating for the need to recognise the true value of nature to scale up investment and regulatory attention for nature.

GLOBAL BRAZIL

NatureFinance co-hosted events with Consórcio Amazônia Legal and the Inter-American Development Bank (IDB) gathering various stakeholders, including Indigenous leaders and development finance institutions to explore the potential and challenges of biodiversity credits.

NatureFinance also joined the Brazilian government to discuss the inaugural Bioeconomy Initiative under the G20 Presidency.