This contribution by Nature Finance and the Sustainable Finance Coalition¹ aims to support the G20 Initiative on the Bioeconomy (GIB) by outlining a selection of traditional and innovative finance solutions and instruments² that can be used to grow the bioeconomy, particularly with clear prioritisation, financial planning, and alignment with development and climate-nature goals as the key starting point for selecting and leveraging financing. Though not exhaustive and open to additions from GIB members, this mapping presents financial solutions and instruments that can be leveraged to bridge funding gaps, reduce risks, and attract private investments in the bioeconomy.

The bioeconomy is a rapidly evolving economic paradigm that is globally recognised as a key driver for sustainable development. It reduces dependence on fossil resources, promotes the use of biomass alternatives and a circular approach across a range of sectors, and promotes biodiversity conservation. It presents a set of viable economic opportunities for a just transition.

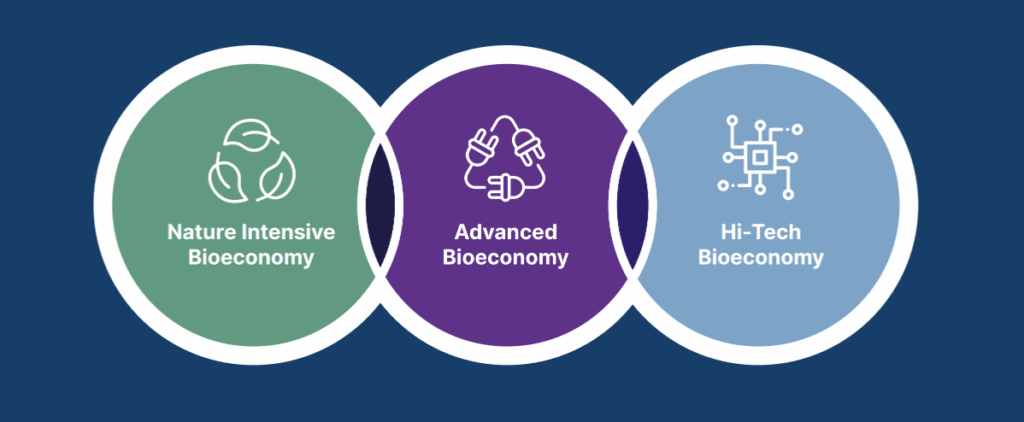

The Global Bioeconomy Stocktake³ identified over 60 countries and regions with bioeconomy or bioscience-related strategies. In order to gain a shared understanding among the G20, the above 3 bioeconomy types were outlined, not to suggest a hierarchy but rather to emphasize the diversity and range of the bioeconomy. A country, and even a single industry value chain, can have examples from each type of the bioeconomy, meaning that not only is overlap possible but part of economic development and diversification.

Contact and more information

For content enquiries, Monique Atouguia, monique.atouguia@naturefinance.net, Lead, Global Africa

For media and communications enquiries, contact Roberta Zandonai, Communications & Engagement Manager, roberta.zandonai@naturefinance.net