Finance for Biodiversity (F4B) has published a new governance model for carbon offset markets that encourages governors of carbon markets to adopt three design principles to ensure the market grows rapidly, adheres to standards, and helps the global economy move toward net zero.

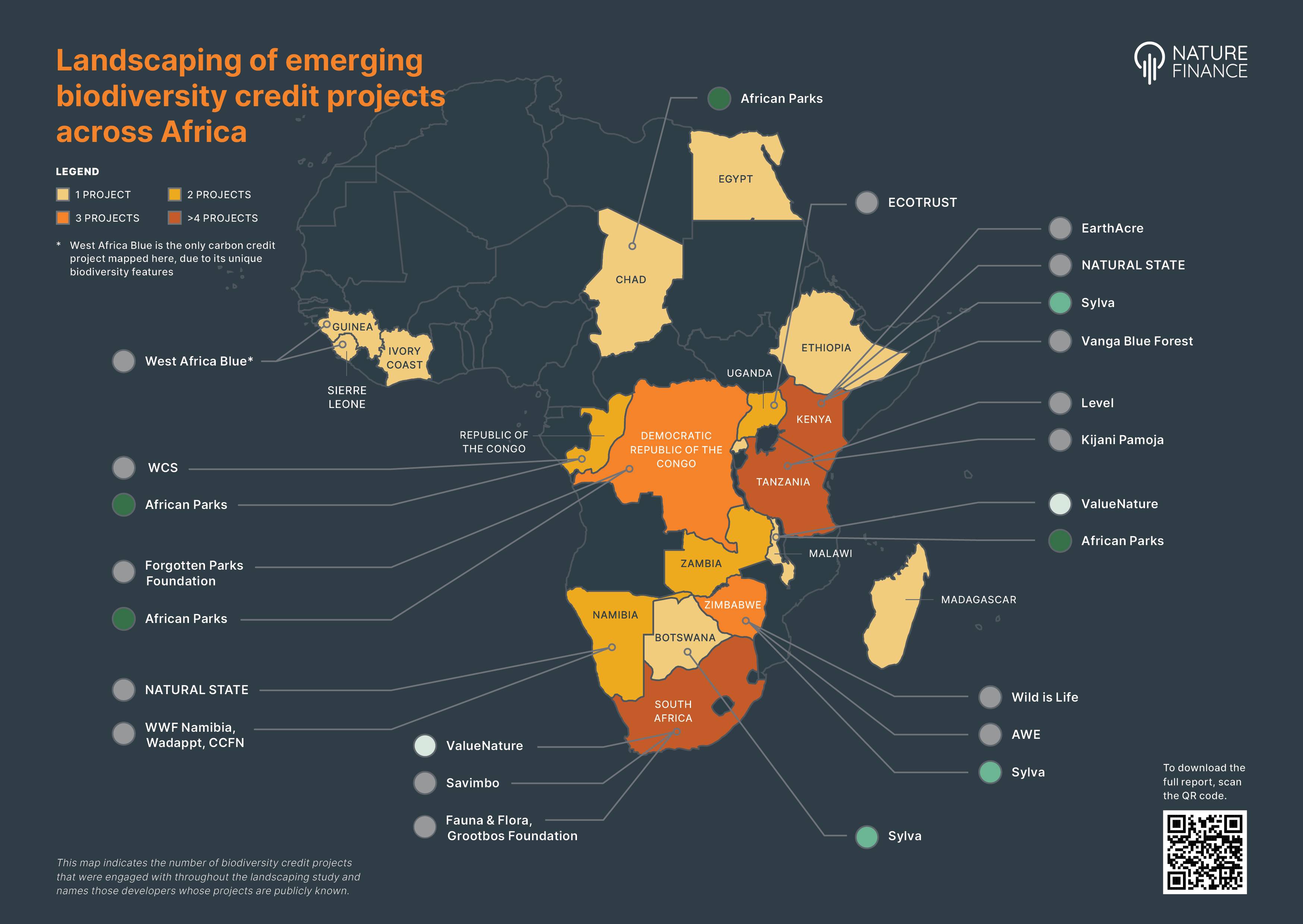

Demand for carbon offsets is set to soar. Both prices and expectations are rising after climate negotiators at Glasgow’s 2021 COP26 agreed on a set of rules for international carbon trading under Article 6 of the Paris Agreement. Yet, despite this demand, and as companies and governments move toward net zero emissions goals, only some forms of carbon markets – invented to fulfil the public purpose of reducing greenhouse gas (GHG) emissions at the lowest possible cost – have been successful. This includes the EU emissions trading scheme (ETS), which has reduced both emissions and compliance costs. On the other hand, project-based carbon markets have failed to scale into a credible, mature market, primarily due to a lack of trust, demonstrating that building integrity is key to the success of these vital markets.