Welcome to NatureAlign

NatureAlign is a suite of analytical modules developed by NatureFinance to support stakeholders within the financial system in aligning their financial flows with nature positive outcomes.

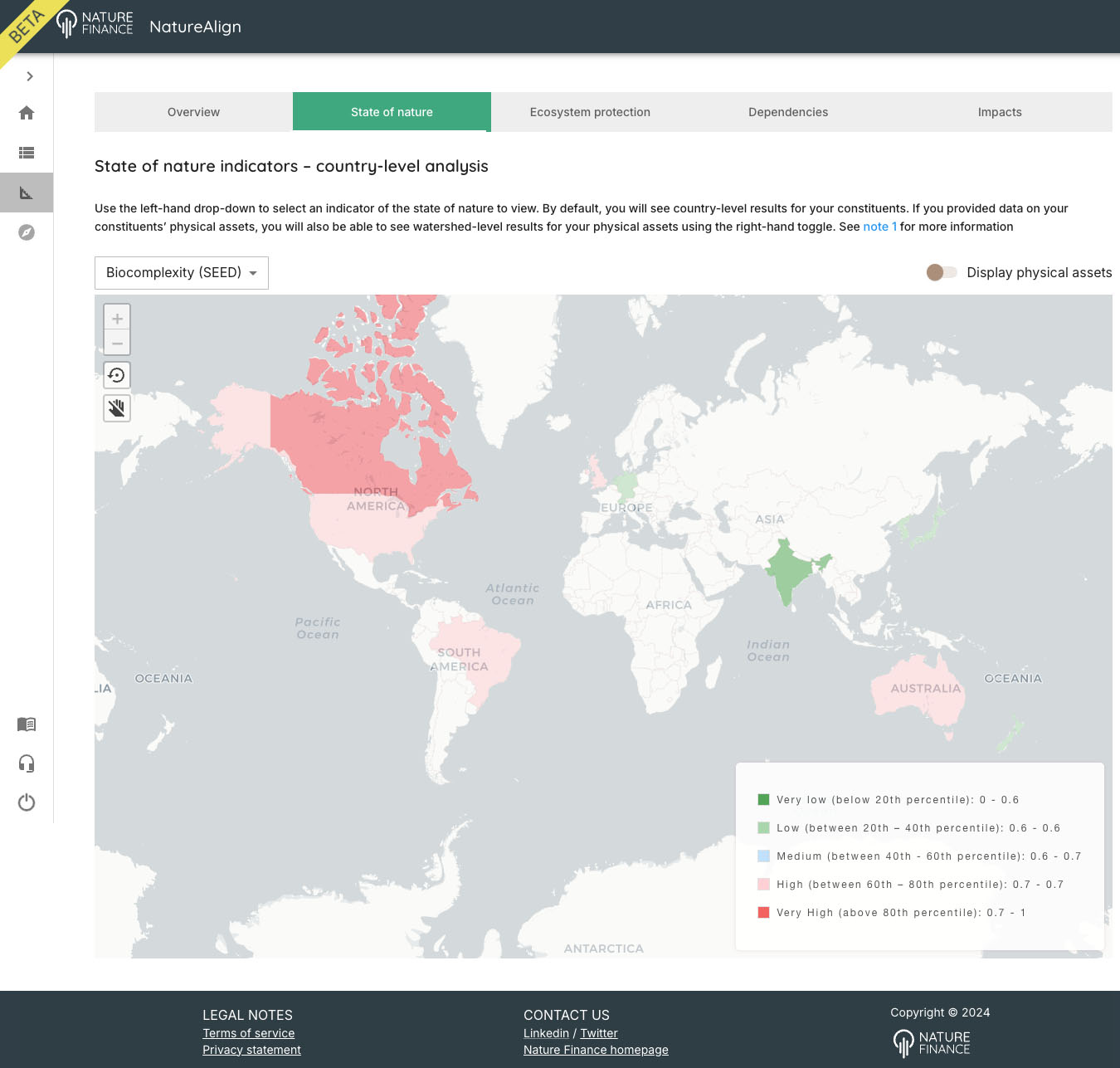

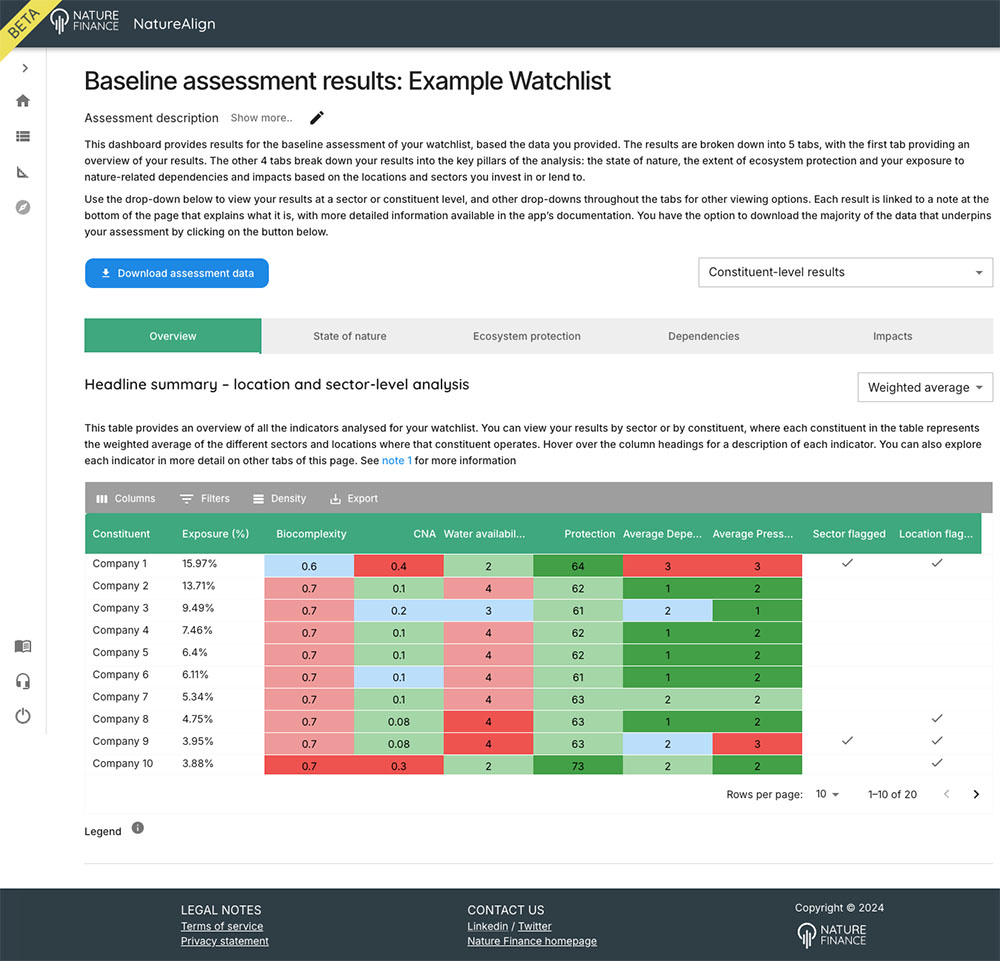

The first module of NatureAlign is a free web app for private financial institutions. The app is being released as a beta version as it is still being developed and improved, with further steps and features on the way. It uses existing biophysical, spatial and financial datasets to provide financial institutions with a baseline analysis of their investments and loans with respect to nature. Its main aim is to arm institutions that fuel economies with the knowledge and tools to account for their reliance and impacts on nature.

This is because financial institutions are key to the nature transition. With nearly $7 trillion, or about 7% of global GDP, invested each year in activities that harm nature, there is an urgent need for financial institutions to shift finance towards activities and sectors that protect, manage and restore the natural world.

Demands on financial institutions to demonstrate the alignment of financial flows with net zero and nature positive outcomes are growing, driven by the need to meet climate and nature goals. For nature, this is highlighted by regulations such as the EU Corporate Sustainability Reporting Directive (CSRD), global frameworks such as the Biodiversity Plan (the Kunming-Montreal Global Biodiversity Framework), and recommendations from the Taskforce on Nature-related Financial Disclosures (TNFD).

Sign up to use NatureAlign for free and progress your nature journey today